estate tax unified credit history

Unlimited Marital Deduction - Amends the Internal Revenue Code to increase the unified credit against the estate and gift taxes from 47000 to 192800 by specified annual increments through 1987. However the federal government cannot appropriate the entire US.

A Guide To Estate Taxes Mass Gov

Buyers outside of New York State need to send us a completed NY State DTF Form before we can remove sales tax from their invoices.

. A tax bill and an information sheet. 732503 or an oath of an attesting witness executed as required in s. Foreign Tax Credit.

Around November 1 each parcel of land is mailed two statements. It also served to reunify the estate tax credit aka exemption equivalent with the federal gift tax credit aka exemption equivalent. Estate and Gift Tax Provisions - Subtitle A.

The Legacy of the Bush Tax Cuts on Taxpayers and the Economy. WTAS opens offices in the Philadelphia and. Do You Need to File Federal Estate Tax Form 706.

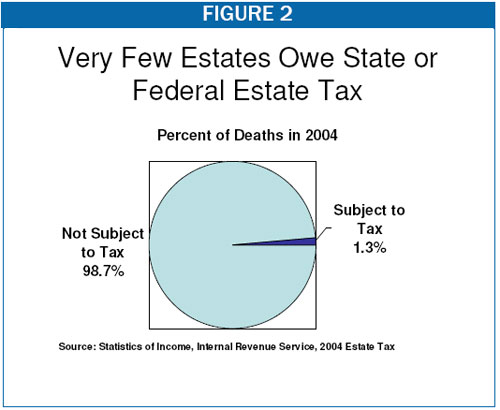

This liability becomes a lien on the real estate on November 1. The tax applies only to the portion of the estates value that exceeds an exemption level. 7332012 is admissible and establishes prima facie the formal execution and attestation of.

Recognized as a leader in client service by the Customer Service Institute of America CSIA Ryan earns the highly coveted 2019 International Service Excellence Award in. 1 A non-discounted rate for payments made with creditdebit cards and. A history of the estate tax shows just how far.

This is because private citizenswho produce the goods and services that comprise the bulk of the economyuse most of these resources to live. An annual exclusion is the amount of money that one person may transfer to another as a gift without incurring a gift tax or affecting the unified credit. 2009 subject to certain exceptions.

Additional Considerations When your parents give you more than 15000 each they. Increase in Unified Credit. Economy to pay its debts.

Recent History of the Tax Code. Andersen provides a wide range of tax valuation financial advisory and related consulting services to individual and commercial clients. Increases from 175000 to 600000 by specified.

A non-refundable tax credit for income taxes paid to a foreign government as a result of foreign income tax withholdings. A self-proving affidavit executed in accordance with s. The other part of the system.

History of Federal Estate Tax Laws. But TRA 2010 was signed into law on Dec. History of Estate Tax Exemption Rates.

For example if she gives you 1 million during her lifetime using her unified credit she can leave only about 104 million estate-tax-free after she dies. In February Ryan is selected to the 2020 FORTUNE 100 Best Companies to Work For list for the fourth time and for the third consecutive year as one of the 100 most premier workplaces in the United States. In 2021 the IRS made the lifetime amount 117 million for a single taxpayer or 234 million for a married couple.

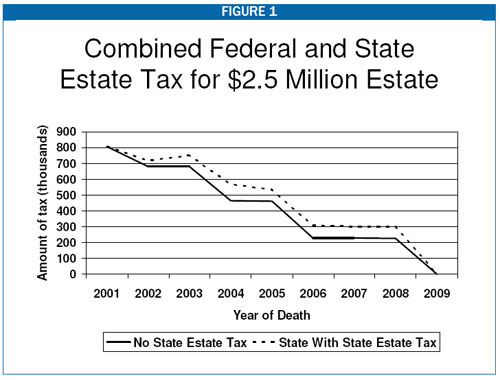

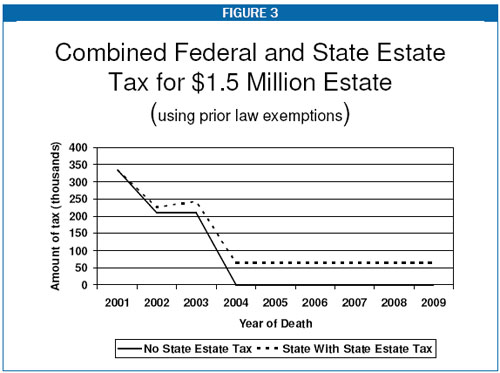

Also state and local governments consume some of the nations GDP. 17 so that loophole actually only gave donors a couple of short weeks to take advantage of tax-free giving if they hadnt already done so in. The landmark Taxpayer Relief Act of 1997 called for a gradual increase in the estate exemption from 600000 in 1997 to 1 million by 2006.

The gift tax only applies once you surpass your exclusions. Although the tax wasnt abolished and the exemption amount increased to 5 million that year from 35 million in 2009 the tax rate was temporarily set to zero. The estate tax is part of the federal unified gift and estate tax in the United States.

The Tax Cuts and Jobs Act TCJA doubled the estate tax exemption to 1118 million. Hence this research sometimes expresses federal debt as a portion. 1 In all proceedings contesting the validity of a will the burden shall be upon the proponent of the will to establish prima facie its formal execution and attestation.

Please note when you are provided an invoice to pay there are two different payment amounts. Investment consulting services state and local tax corporate taxation real estate services personal accounting solutions and international tax capabilities. The tax bill is the amount to be paid and includes full instructions.

The information sheet compares current year values rates and taxes with the prior year for the same parcel. In 1976 Congress enacted the generation-skipping transfer GST tax and linked all three taxes into a unified estate and gift tax.

Assessing The Impact Of State Estate Taxes Revised 12 19 06

Estate Tax Rate Schedule And Unified Credit Amounts Download Table

Exploring The Estate Tax Part 2 Journal Of Accountancy

How Do Millionaires And Billionaires Avoid Estate Taxes

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Historical Estate Tax Exemption Amounts And Tax Rates 2022

How To Avoid Estate Taxes With A Trust

U S Estate Tax For Canadians Manulife Investment Management

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Assessing The Impact Of State Estate Taxes Revised 12 19 06

Pin By Zaloom Law Firm Pllc On Estate Planning Historical Gift Estate Planning Historical

It May Be Time To Start Worrying About The Estate Tax The New York Times

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

U S Estate Tax For Canadians Manulife Investment Management

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm